Kazia Jaszkiewicz

Kazia Jaszkiewicz Julia Alcântara

Julia Alcântara Billy Hazel

Billy Hazel Guiri Uribe

Guiri Uribe Luci Matheus

Luci Matheus

NY futures traded in volatile fashion this week, with December giving up 316 points (based on last week's synthetic value) to close at 115.71 cents, while March dropped 444 points to close at 110.31 cents.

We believe that the market's yo-yo performance this week is a reflection of the tug-of-war that is currently going on between speculators and the trade. After last Friday's powerful key reversal we saw speculators take profits by selling into strength. This is evident from the most recent ICE spec/hedge report, which shows that spec longs were down by 8'800 contracts as of last Friday.

While spec selling has been pushing values lower on several occasions this week, the trade has been readily buying these dips, because the cash market seems to be unfazed by what's happening in New York and has been holding strong. We previously mentioned the importance of the spread between the A-index and NY spot futures, which historically has been at around 5-7 cents, with occasional spikes towards 10 cents. When spec selling pushed December below 110 cents this week and the A-index refused to give up a lot of ground, the spread was allowed to widen to as much as 17-18 cents, which was an invitation for the trade to step in and buy the board.

The A-index has risen from 125.00 cents on Monday to 131.20 cents this morning, which means that the A-index/spot futures spread is still at a relatively wide 1549 points compared to the historic norm. As long as the cash market keeps paying the prices we are currently seeing, it will be difficult for NY futures to sell off. Mills in the Far East are still willing to pay 132 cents for nearby high grades and around 129-130 cents for February/March shipment.

This means that if someone were to buy the December futures contract, take delivery of it and then ship it to the Far East, it would yield a small profit based on current prices. It takes around 13-14 cents for quality premium, transportation, commission and some carry to get certified cotton to a landed C+F Far East price, which close of December would calculate at around 129-130 cents.

In reality though, any certified cotton bought on the December contract would probably not make it on the vessel before February; for the March contract it would take until May and so on. In other words, we need to compare December futures to a cash price for February/March shipment, based on which December was more or less at 'break even'.

We still believe that the cash market is holding the key to prices and that the futures market has no other choice but to follow it. We therefore need to focus on what cash prices are likely going to do over the coming months. Some traders fear that demand destruction will be severe enough to force prices lower in six to nine months from now and this may explain why July futures are valued at ten cents below December. Although there is no doubt that these high prices will take some toll on mill demand, we need to be careful not to conclude that this will automatically translate into lower prices.

First of all, we don't really know from what level we need to start discounting mill demand. Are we currently at 120.8 million bales as the USDA numbers suggest or did we underestimate demand altogether since the financial crisis? You may remember that in early 2008 we were looking at global demand projections of over 128 million bales for the 07/08-season. Based on what we have seen in China over the last two seasons, there is a distinct possibility that demand has been a lot stronger than 50 million bales. Let's not forget that China was already using 51 million bales three years ago!

Secondly, even though we may see mill demand decline by a few million bales, Chinese Reserve buying is more than likely to offset its potential impact. Since May 2009 the Chinese Reserve has auctioned off around 16.5 million bales of its stocks and will need to replenish most of it whenever it gets a chance to do so. We therefore expect demand for US exports to remain strong well into next season.

So where do we go from here? Cash prices are the guiding light in this confusing market and as long as they remain strong, the futures market won't fall apart despite all the spec selling there might be. If December becomes too cheap in relation to the physical market as we approach its notice period next month, the trade will simply use it to source cash cotton. We feel that as a rule of thumb the futures market should trade no lower than 14 cents below what mills are willing to pay for MOT high grades. If that price is 130 cents, then futures are likely to stay above 116 cents, and if physical prices move higher, the futures market will adjust accordingly.

Although physical prices paid for US cotton may seem expensive at current levels, they are still relatively cheap compared to what Chinese mills are paying. CC-index, the benchmark for Chinese prices, stood at just under 170 cents, while the last installment of the government auction was fetching prices above 176 cents and the November futures contract traded above 180 cents.

At what point this powerful bull market will reach its top is still anybody's guess, but this week's downward revision of the Chinese crop by the CCA to just 29.4 million bales (2.1 million below the current USDA estimate) and the damaging hail and rainstorm that moved through West Texas this evening are only adding further fuel to the fire.

Models present creations by SHIYAN of Russia during the Volvo fashion week in "Gostiny Dvor" Exhibition Hall, Moscow, Russia, Oct. 25, 2010.

According to the report by China daily, Coach Inc, the US-based handbag and accessories retailer, plans to open 25 stores in China during its current fiscal year, which ends in June 2011.

The company is stepping up efforts to expand its outreach in the country considered to be the fastest-growing luxury goods market in the world.

New York-based Coach, which owns 665 stores worldwide, now operates 41 outlets in China. During the past fiscal year, it has opened 15 stores in the market.

"China is our biggest opportunity as our brand takes hold and the market continues to develop rapidly," said Lew Frankfort, chairman of Coach Inc, adding that the company has started developing a multi-channel distribution model in China including a flagship store, retail outlets, and shop-in-shop. He said the company is also expecting to accelerate new store openings.

A new Coach's retail store will be opened in Dalian, Liaoning province, on Friday.

As an accessible luxury brand, Coach sells products at a relatively low price - about half that of some European brands such as Louis Vuitton (LV), Gucci and Prada. In China, Coach's handbags are mostly priced close to 5,000 yuan ($752) while LV and Prada are around 10,000 yuan.

"China is growing at a faster pace than expected and we will reach our sales target of $250 million in the market by June 2012, a year ahead of the planned time frame," said Victor Luis, president of Coach's international retail branch.

Earlier this month, the US brand announced its international growth strategy, focused on Asian markets, which includes establishing a new international retail organization with three major Asian hubs including the Chinese and Japanese markets.

"Coach is now well positioned to drive our directly-operated international retail businesses, while continuing to accelerate the development of the global market and growth through our partnerships around the world," Frankfort said.

Coach acquired its domestic retail businesses in April 2009 from its former distributor, ImagineX Group, a Hong Kong-based brand management and distribution company in the luxury market.

The company said the direct operation provides greater control over the brand in China, enabling it to raise brand awareness and grow its market share with domestic consumers.

According to Coach, the global luxury market for handbags and accessories is about $24 billion and China comprises roughly 10 percent at present.

"We estimate that by 2013, the global luxury market for handbags and accessories will be about $29 billion, and China's share will grow to 20 percent from the current 10 percent," Frankfort said.

A survey by the US consultancy Bain & Co released this month showed China remains the fastest-growing market for luxury goods, with sales expected to rise 30 percent this year. Global sales are predicted to grow 10 percent.

While Coach is exploring the Chinese market, it still sees potential in Europe. The (London) Financial Times reported that the retailer plans to open up to 15 outlets in the United Kingdom over the next three years.

In France, it opened its first shop, inside a Printemps store in Paris, in June.

Bain said sales in Europe - where luxury brands account for around 75 percent of the global market - will rise 6 percent this year, fuelled by customers from emerging markets like China.

The Hongliang Tannery started a leather production project with annual annual capacity of 600,000 pieces of cow leather on October 22, 2010 in Guanghe Economic and Developing Zone in Guansu, the northwest province of China. The leading brands of footwear groups including Aokang, Belle, Senda, Red Dragonfly and many industrial experts and scholars presented on opening ceremony, concurrently a leather engineer and technical research center also founded in the tannery.

Guanghe County in Guansu province was a fur skin distributing and trade center since ancient time, and now leather industry is a most important sector for local economic. In recent years the industry has grown rapidly and boosted the local economy prosperous. Hongliang Tannery with total assets of 480 million yuan is a leading enterprise in Guanghe leather industry, the newly opened production line is a project listed in the revitalization and technical renovation program for national key industries, which is launched by National Development and Reform Commission and Ministry of Industry and information.

The nwe project with total the investment of over 80 million yuan will double the production capacity of Hongliang Tannery that may rank the fifth national wide in terms of production. As one of leading enterprises Hongliang Tannery will play an important role on boosting animal farming and solving the surplus rural labor employment, as well as on driving the economic growth.

A proposal to ban raw cotton exports had been drafted by the Ethiopian Textile Industry Development Institute (ETIDI) and in all likelihood, the Ethiopian government is planning to impose the ban.

The textile sector has been insisting on banning exports of raw cotton for the main reason that domestic demand for the white gold has outstripped the supply, and if it runs short, cotton will have to be imported by spending valuable foreign exchange.

However cotton exporters are up in arms and have raised concerns over the proposal as they have already taken orders from international clients and if the ban was to be imposed, it would mean reneging on commitments.

Another viewpoint put across by experts is to add value to the raw cotton in Ethiopia itself rather than exporting cotton, as it will help generate seven times more value against that generated by raw cotton exports, which could help in bring in much needed foreign exchange.

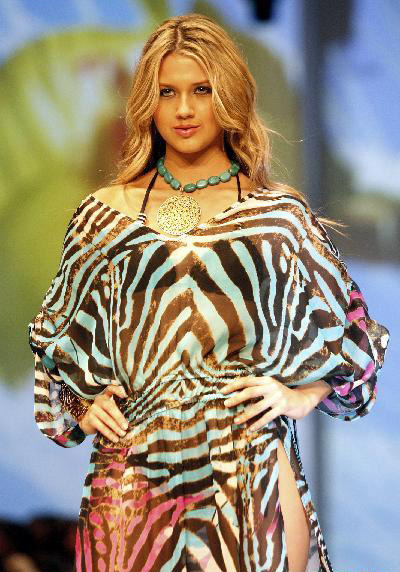

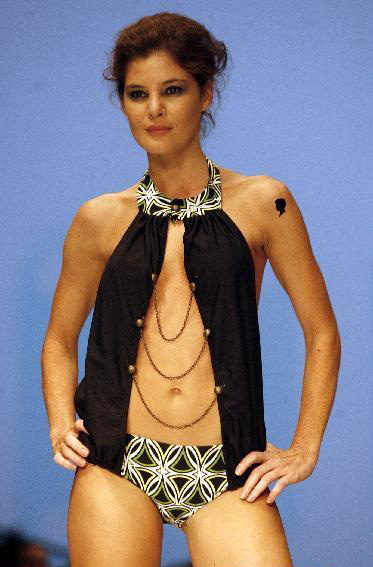

Models display creations of Paula Saavedra during the Cali Exposhow fashion show in Cali, Colombia, Oct. 23, 2010.

Models display creations of Romona Keveza during Toronto Fashion Week Spring/Summer 2011 in Toronto, Canada, Oct.21, 2010.

Models present creations by Georgian designer Avtandil during Georgian Fashion Week in Tbilisi, October 22, 2010.

Models present creations during Moscow Fashion Week, October 22, 2010.

This fashion show named "Extension" was opened in October, 24 during Shanghai Fashion Week. The famous designer Hua-juan, cooperated with the architect Zhou-wei, provided us a very excellent vision feast.

In this show, Hua-juan uses the contrast of different horniness materials, the combination of different colors and light, the consummate designing skill and technique to show us a exquisite, purity and gentler brand-JudyHua. Through her works, she wants to express the idea of "Architecture and Garment are not only the materialize extension of human's culture and dream, but also connected with our soul and believe, survival philosophy and life style. It is the beauty of life and the headspring of happiness."